What is a Maintenance Plan?

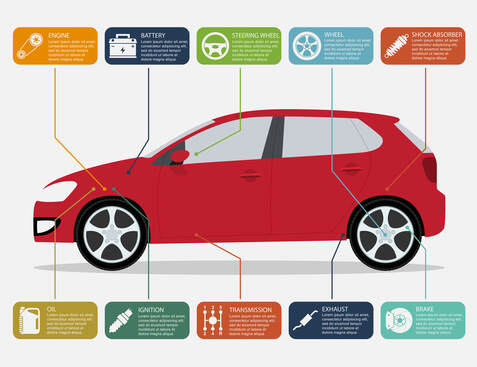

A car maintenance plan covers services that the vehicle’s manufacturer recommends be completed to keep the car running in optimum condition. These things could be oil changes, filter replacements, and tire rotations. Dealerships have learned that offering maintenance plans can be a very profitable revenue stream for their business.

These plans are prepaid and can be very valuable to have, but you need to carefully consider what is covered and what you would pay out of pocket compared to the cost of the plan. Always read all of the fine print details, and if you don’t understand the contract, consider having an attorney explain it to you.

The Positives of Purchasing a Plan

For example, the average cost of an oil change in South Carolina is around $30. Assuming you change your oil as recommended, or about every three months, that is $120 a year. Tire rotations are about $40, and it needs done once a year. Filter costs vary, but you may plan on about $100 for filters a year. If this is your plan of maintenance, you will be paying about $260 a year in car maintenance. (You also need to check your car’s owner’s manual for recommended maintenance.) If you can get a car maintenance plan for less, it may be worth it.

The Negatives of Purchasing a Plan

An example of this would be that new vehicles require very little maintenance. Many cars will go for more than 5,000 miles (instead of 3,000) between oil changes. This reduces your out of pocket expenses. Many manufacturers now state that your vehicle will only need significant servicing every 30,000 miles. If you don’t drive much, a car maintenance plan is probably not a good option for you.

Also, once you purchase the plan, you will have no options about who services your car. Unless you decide to pay out of pocket, you will have to take your car to the dealership for services. If you aren’t happy with their service, you have no options. Another thing to consider is that the things that do wear out quickly, such as wipers and brake pads, are not usually covered by maintenance plans.

The dealership may also sell the plan according to their schedule of maintenance and not what is recommended by the manufacturer. If you drive often in extreme heat or cold, oil changes may be recommended more often, but your dealership may not take these conditions into account, and you will have to pay for the oil changes yourself.

RSS Feed

RSS Feed